Charitable Remainder Annuity Trust

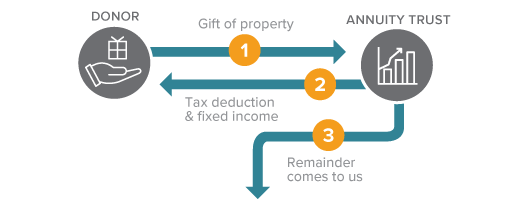

How It Works

- You transfer cash, securities, or other appreciated property into a trust. The required minimum for this type of gift is $100,000.

- The trust makes fixed annual payments to you or to beneficiaries you name.

- When the trust terminates, the remainder passes to Palo Alto Medical Foundation to be used as you have directed.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no up front capital gains tax on appreciated assets you donate.

- Use the trust to meet needs that are tied to a specific time frame, such as college tuition payments.